We all now know that the real estate market is rough, with buyers pulling out every option to try and win their next home. One of the biggest hurdles to overcome when purchasing is the appraisal.

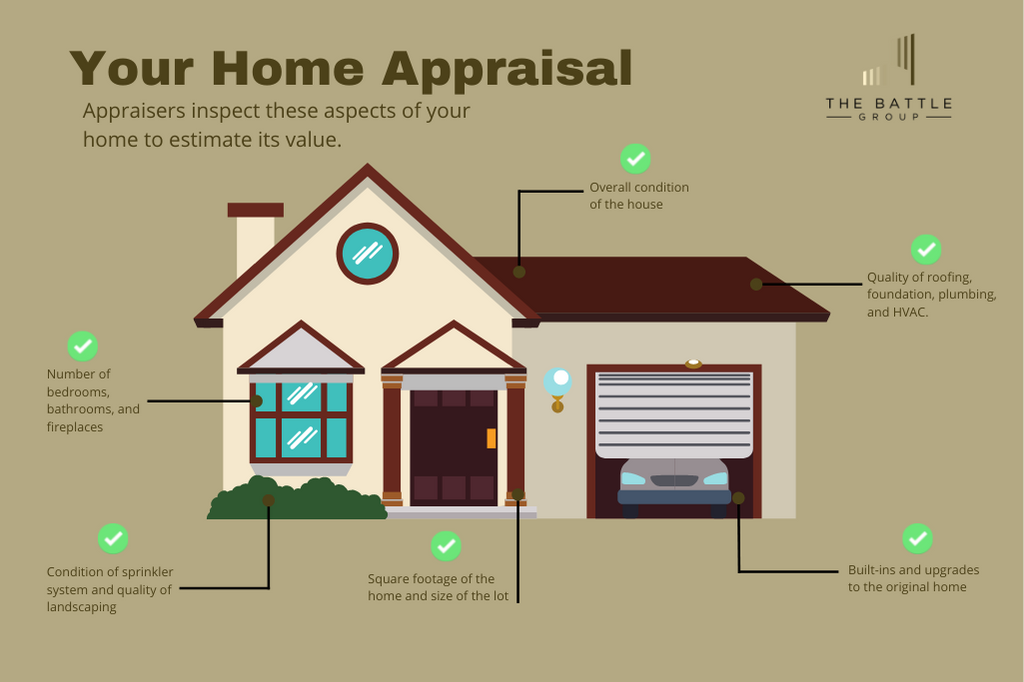

As competition and demand increase, so do values. Banks hire independent appraisers to visit the home while it is under contract to take measurements, look at upgrades, and weigh in on comparable sales in the neighborhood to get a valuation of the property. That appraisal is then sent to the bank and then goes through an underwriting process. That’s correct, the bank has the final say on whether they think that appraisal is legitimate.

Most winning buyers today are waiving their appraisal contingency. Meaning they are risking the fact that the value could come in lower than the contract price and face the consequences of a low appraisal. A lot of people think that you would have to bring the difference between the appraised value and contract price in cash. But that isn’t the case. If you qualify, they can just change your down payment percentage.

This brings about what we are starting to see in the business. The first is an appraisal waiver, where the bank looks at the buyers’ qualifications, down payment, and values in the area and determines that they don’t need an appraisal at a certain price. This allows the buyer to waive the appraisal with very little risk.

The second is a desktop appraisal. This is where the appraiser never visits the home and they base the value of the property on comparable sales, pictures, and floor plans. These are becoming much more prevalent, but do they have pitfalls?

Watch this episode of the “Shawn and Matt Show” to see what we think.